By Tristan Smith, University College London, Energy Institute

When first asked to write this, we were still in the early stages of the crisis (at least in Europe) with early signs emerging on how Covid-19 might impede or accelerate our response to the risk of dangerous climate change.

The impacts of Covid-19 on my own work have meant a delay to writing this, and in the interim period thousands of words have been written, including on the interaction between Covid-19, shipping, decarbonisation more generally, and shipping’s decarbonisation. The two basic forces at play being characterised as:

- Pessimism – doubt that governments and firms will have the spending power coming out of Covid-19 in order to make the investments needed to decarbonise as needed

- Optimism – that Covid-19 acts as a wake-up, a cruel metaphor tipping us (society, governments and firms) into realisation of the more general urgency for sustainability

With these two counteracting forces at play it is hard to identify what the net impact might be (including on a subsector like shipping). However, to attempt to do so, this article considers the Covid-19 crisis’ impact on shipping’s decarbonisation primarily based on how business-case and regulation might be disrupted.

This is broken down both into the short-term (to 2025) and the longer term (2025+). The specifics of investment allocation (by firms and governments) are not second guessed, but discussed in light of the analysis, in a set of concluding remarks.

Short-run (the early 2020’s): a harder business case for lower carbon intensity and the early shift away from fossil fuels

Candidate non-fossil fuels (bio and hydrogen-derived fuels) already looked likely to be more expensive than the LSFO and MDO predominantly used today, at least in the short-term. This makes sense, otherwise they would be in use already.

Covid-19 is clearly a major contributor to the recent global contraction in demand for oil and the crash in oil price, which has in turn made LSFO and MDO dramatically cheaper than they were at the start of the year.

Candidate non fossil fuels are incredibly hard to forecast prices on, but the new entrant biofuels were becoming more competitive and approaching some of the upper bounds in MDO price movements, especially those transiently high oil prices shipping experienced during Q4 2019 and Q1 2020 around the introduction of the 0.5% sulphur limit.

With prices for those biofuels significantly influenced by costs of production there is less of a driver for a reduction in their price than the drivers to lower fossil oil prices. The over-supply induced oil price crash has made the price spread to biofuels larger, and so the business case to switch in the short run away from fossil appears to have become harder. For some with pockets deep enough to take a long-run strategy, or who have found niche regulatory or other commercial incentive to override a pure energy-price related business case, this change in price spread may not be enough to change their decisions. But for those where the decision was already marginal, it will not help.

Besides the use of non-fossil fuels, there are other means to reduce carbon intensity including investment in energy efficiency technologies and modifications to operational practices most notably ship speeds and voyage optimisation.

Much of the change here is also driven by the business case and not regulation. And lower oil prices mean a longer return on investment for technology (given payback for the investment comes from fuel savings which are fuel price driven), and it can also mean higher ship speeds and voyages less optimised to lower fuel consumption. The most obvious illustration of the latter is the return by some (e.g. CMA CGM among others) of sailing “the long way round” Africa to avoid Suez and the canal charges, at the expense of much higher fuel consumption. Clearly, ship operators are not incentivised by minimisation of fuel costs alone.

Policy makers know fuel price alone is not sufficient to manage shipping’s decarbonisation, which is why an expected driver for lower carbon intensity during this coming decade, particularly in the existing fleet, is regulation by IMO known as “short term measures”.

Two main categories of policy options are under consideration: those improving either the design/technical carbon intensity of shipping, and those improving the operational carbon intensity of shipping. A decision could have been made to agree to implement one of these at MEPC 75 originally scheduled before Easter. However, that meeting’s postponement (remaining, for now, unscheduled), does not work in favour of compensating for weaker business case drivers on lower carbon intensity.

Long-run: Covid-19 creates little change of the urgent need to decarbonise and could amplify the justification for policy to shift from fossil fuels, as well as improve the business case for blue hydrogen/ammonia

For some time, our analysis work has shown that to get anywhere close to the IMO Initial Strategy GHG Reduction scenarios, shipping will need a rapid transition away from the use of fossil fuels. The mostly market driven reductions in carbon intensity using energy efficiency need to be built on over this decade, but from the late 20’s onwards a more radical shift for the sector and its energy suppliers appears impossible to escape.

The most recent study we have done on the subject can be found in analysis to support the UK government’s Clean Maritime Plan (https://www.gov.uk/government/publications/clean-maritime-plan-maritime-2050-environment-route-map). The energy mix that results from one of the less ambitious scenarios, albeit a scenario that is in line with the IMO Strategy, illustrates the scale and speed of change to the conventional fossil fuel supply (https://www.globalmaritimeforum.org/news/the-scale-of-investment-needed-to-decarbonize-international-shipping).

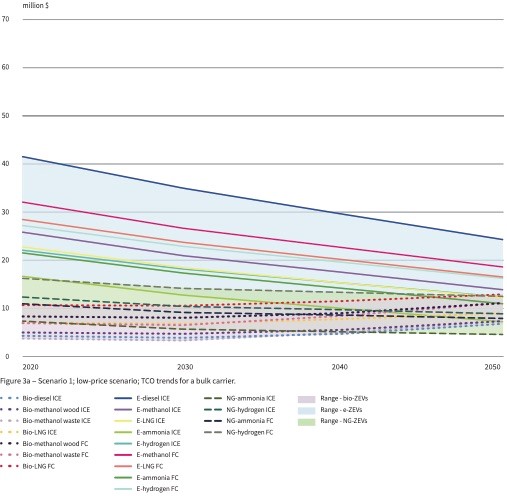

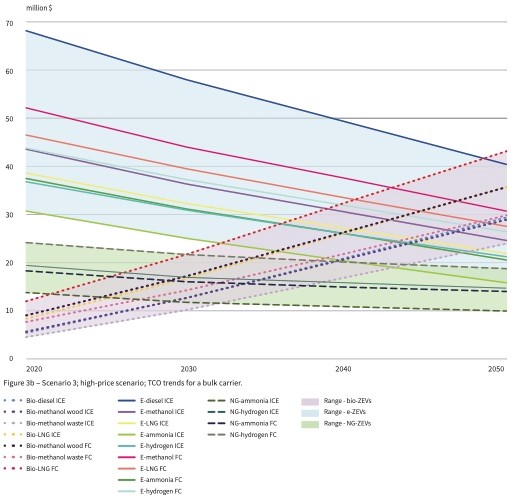

In much of our recent work on modelling the techno-economics of candidate future shipping fuels, the largest driver of the total additional cost to operation with those fuels is the fuel price premium of the fuel relative to the incumbent fossil fuels. Our most recent update to that area of analysis concluded: Yes, there are other impacts on the total cost (for many options: the capital cost of the extra storage and fuel handling equipment, the machinery, the loss of cargo carrying capacity due to a relative decrease in energy density of the fuel), but it is the price of fuel that is by far the most dominant driver in the relative competitiveness of different candidate future fuels.

Note that none of these plots have a comparator to a conventional marine fossil fuel (e.g. LSFO or MDO). So whilst cheaper oil and gas may mean an increase in the spread to non-fossil fuels, it does not remove the fact we need them to avoid dangerous climate change.

Policy was already needed to help close the gap to enable the business case for non-fossil fuel use, and a lower oil/gas price environment will only make that necessity greater and provide a clearer justification. There are even suggestions that lower fossil energy prices can make it easier to introduce GHG policy, because the lower price provides some headroom for a policy intervention to occur with no net increase in overall cost.

One inference from the plots is that before the oil/gas price reductions associated with Covid-19, the lowest cost future fuel with good long-run potential was hydrogen/ammonia (initially from natural gas and CCS, blue, with potential to move to electrolysis production, green, in the future).

One consequence of the oil/gas price reductions will be a reduction in the price of blue hydrogen/ammonia and a likely improvement in its competitiveness relative to both green and biofuels. This may provide a clearer signal and investment case for the use of blue hydrogen derived fuels (e.g. blue ammonia) in the transition from fossil fuel use and advance their deployment.

One of the uncertainties in shipping’s decarbonisation is the role of the marine fuel option LNG. This cleaner fossil fuel has small and uncertain GHG advantages relative to oil derived fuels. So the fossil variant cannot be a significant fuel in the decarbonised long run.

As shown in the graphs below, LNG’s bio and synthetic equivalents (liquid bio-methane and synthetic methane) are not competitive relative to hydrogen/ammonia in the long run, so also do not present a credible longer-term option.

However, as long as strong policy to shift shipping from fossil fuels is not present, there can be a business case for LNG relative to incumbent oil derived fuels, as long as the expected price/availability of LNG bunkers relative to oil derived fuels offsets the higher capital cost of the equipment.

Under Covid-19, the driver for LNG remains the short-term business case and whether that can create a return before policy drives a transition away from fossil fuels. Whilst gas prices may now have a period where they are lower than they were in many forecasts produced last year, as long as similar price reductions are experienced by oil derived fuels, the spread and therefore the business case may not become stronger, or be significant.

Some firms may find a niche where investment in LNG as a marine fuel can work under these circumstances, but the risks created by the long run and of an acceleration away from fossil fuel continue to make a significant shift towards LNG directly as a fuel (as opposed to as a feedstock for blue hydrogen/ammonia) hard to foresee.

Its primarily about what governments, and maybe also firms, do next, but there are opportunities to seize that may not come along again in a hurry

We know there is more oil and gas in current reserves than there is a market for (assuming we get anywhere close to achieving the Paris Agreement temperature goals). There appears little recognition in the energy sector (the oil producing governments and corporates, the advisors, even the IEA) of a narrative about production and supply contraction of oil and gas anywhere close to a Paris Agreement compatible trajectory. But we also know there are 60+ governments writing or considering writing “zero GHG by 2050” into their policy and industrial strategies.

With dangerous climate change already locked in (the option is now to avoid catastrophic climate change), we can expect only growing disasters and therefore a crescendo of pressure for more governments to join this ambition or even increase it. This is creating a strengthening demand signal, removing demand from fossil fuels and increasing demand for its sustainable alternatives (renewable electricity, hydrogen and its derivatives).

This dichotomy (simultaneous pressure to sustain/increase supply and reduce demand for fossil fuels) embeds systemic risk of sustained over supply, as many governments come in to control demand for oil and gas in their economies in order to fulfil domestic Paris Agreement commitments (Nationally Determined Contributions). In many ways, Covid-19 may have brought forwards the long-run trend of lower/falling fossil fuel prices that was already the likely backdrop to shipping’s decarbonisation.

Alongside the fossil fuel supply/demand dynamics, there is now a growing call for a non-fossil fuel supply stimulus being brought forwards: https://www.weforum.org/agenda/2020/05/green-stimulus-policy-decarbonization-shipping-industry-renewable-energy-transition-fuel/ and many governments rapidly forming hydrogen strategies. Covid-19 and the stimulus that will be needed to recover our economies, has created the potential to bring forwards actions that might have been scheduled for a few years into the future. This is partly because Covid-19 disruption to our lives has made accelerated policy against cars and aviation and pro cycling and electrification easier.

It is also because the consequence of bailouts and much higher reliance on public funding across the private sector, will make it easier for governments to influence and control the private sector in-line with their climate commitments. As one government employee I spoke to recently elegantly expressed in metaphor: “we’ve been using screwdrivers up till now, now we’ll need to start using hammers”.

There are also opportunities for firms arising. Oil and gas majors already had a toxic mix of increasing shareholder pressure to decarbonise, expectations of lower volume growth, strong potential for lower prices and for asset write-downs. With Shell and maybe others announcing dividend payment cuts, they will lose investors searching for a short-run profit and high dividend – one of their main drags on making longer term energy transition-oriented investments.

If this can be aligned with government pressures, it could prove to be a pivotal point for this set of firms capable of providing at scale investment (and investment deployment) in technologies and infrastructure needed for shipping’s decarbonisation.

Counteracting the opportunities that Covid-19 has presented, are the economic impacts of Covid-19 on balance sheets. Both governments and firms will face huge pressure to rein-in spending and bring in revenue in the short-term. To conclude, the initial framing of a reason to be optimistic and pessimistic regarding the speed at which decarbonisation may move remains. However, the clarity and urgency of the challenge, and the scope to take some control of it has never been greater.